Need Immediate help? Call 717-397-1010

After Hours Call / Text 717-471-2168

Need Immediate help? Call 717-397-1010

After Hours Call / Text 717-471-2168

While many are familiar with the idea of pain and suffering as it results from other injuries and incidents, few are aware that mental injuries themselves can be compensable. Mental injury claims often come from workplace stressors and are on the rise as claims. For employers, this raises a lot of issues and creates a lot of headaches, especially in their HR departments. It is much more difficult to successfully claim one of these cases, and the issue brings up a lot of questions for both employees and employers.

While many are familiar with the idea of pain and suffering as it results from other injuries and incidents, few are aware that mental injuries themselves can be compensable. Mental injury claims often come from workplace stressors and are on the rise as claims. For employers, this raises a lot of issues and creates a lot of headaches, especially in their HR departments. It is much more difficult to successfully claim one of these cases, and the issue brings up a lot of questions for both employees and employers.

Understanding the link between stress in the workplace and the mental and physical disorders that result is problematic. For instance, it is not yet fully proven that workplace stress can directly cause anxiety and depression, and it is even more burdensome to prove that the anxiety and depression did not exist in any way prior to the work stress. Even further, it is not easy to prove ongoing stress at work is the cause of a heart attack versus genetics or at-home stressors.

However, it is an important aspect of work-life that needs to be better understood. The National Institute of Health estimates that the American economy spends close to $150 billion each year on stress-related issues. This number was estimated based on decreased productivity, missing work, and massive increases in medical expenses. It is also not too uncommon, especially in larger corporations, for there to be millions spent each year on stress management programs.

However, these programs largely seem to not work. The claims of stress-related mental illness and cardiovascular injury continue to rise but most employers and employees are no closer to answering which work-related stress injuries are compensable and which are not. Distinguishing the two from one another comes down to understanding the medical concepts associated with stress along with an understanding of how the legal framework of these concepts should be applied, which is out of the scope of experience and knowledge of most employers.

The burden of proof is the biggest aspect of proving such a case. It is important to know there are three different classifications of these types of claims: physical/mental, mental/physical, and purely mental. In a physical/mental injury, a physical stimulus leads to a mental injury. In a mental/physical injury, a mental or emotional experience leads to a physical injury. In a purely mental incident, there is a mental or emotional stimulus that leads to a mental injury. If you have been a victim of any of these three incidents, contact us today. Our team will help you build evidence to ease the burden of proof and bring you closer to the compensation you deserve.

Some injuries at work are more complicated than others. For instance, if you are asked to come in and pick something up for or from your boss and are injured on the premises, you may wonder if you are eligible to receive Workers’ Compensation benefits. While you were not on the clock, you were at your place of work and your actions were in benefit of the employer. In a lot of claims like this, you will have a good case for compensation. However, the devil is in the details when it comes to such claims.

Some injuries at work are more complicated than others. For instance, if you are asked to come in and pick something up for or from your boss and are injured on the premises, you may wonder if you are eligible to receive Workers’ Compensation benefits. While you were not on the clock, you were at your place of work and your actions were in benefit of the employer. In a lot of claims like this, you will have a good case for compensation. However, the devil is in the details when it comes to such claims.

The first question is whether it was in the scope of your employment or not. For instance, if you stopped in the office because you left your cell phone on your desk, it was not in the interest of your employer nor was it in the scope of your employment. However, running an errand for your boss or coming in to prepare for your next shift is a different story. In those cases, you would not have been on the premises and would not have been injured had it not been for your employment.

In most states, these benefits cover medical costs and lost wages when an employee is injured during the course of their employment. There are some exceptions to this general rule.

The law surrounding Workers’ Compensation is rarely black and white. The law tows the line between protecting the rights of workers while also looking out for the best interest of the company as a whole. Some of the exceptions for injuries that are technically off the clock but are still covered by Workers’ Compensation include:

Working outside of regular business hours and coming by after hours are also usually covered by the exceptions. If you have been injured while off the clock but feel you still deserve compensation, contact us today. Our professionals will help you figure out your legal options.

The short answer to this question is “no,” but there are some caveats to the answer. While Workers’ Compensation benefits are not considered taxable income at the federal or state level, those receiving benefits through Social Security disability insurance or Supplemental Security Income in addition to Workers’ Compensation may have their benefits taxed.

The short answer to this question is “no,” but there are some caveats to the answer. While Workers’ Compensation benefits are not considered taxable income at the federal or state level, those receiving benefits through Social Security disability insurance or Supplemental Security Income in addition to Workers’ Compensation may have their benefits taxed.

For some, their SSDI or SSI may be reduced to ensure the combination with Workers’ Compensation is below a threshold of payment, known as the Workers’ Compensation offset. The amount of Worker’s Compensation that would be taxable is the amount your disability payments are lowered to stay within that threshold.

In these cases, it pays to have an experienced Workers’ Compensation attorney on your side. A good lawyer will be able to ensure the offset will be minimal and reduce how much of your income is subject to taxes. However, it is important to know that most people who have this offset most often don’t have enough taxable income to owe federal taxes. As such, it is unlikely you will owe taxes, even under this exception.

Structuring your Workers’ Compensation with an experienced lawyer can alleviate a lot of taxable income concerns. Not only can it help minimize the Worker’s Compensation offset, but it can also limit the amount of taxes you will have to pay.

One way to avoid unnecessary taxable income is to receive a lump sum that should be treated as though it were to spread out throughout your expected lifetime. This will cover the rest of your lifespan while avoiding thresholds found in monthly payments.

When receiving both types of compensation, the total benefits cannot exceed 80% of your average earnings at your current employment. These average earnings are considered the largest out of the following:

If you are filing for Workers’ Compensation and are concerned about going over the threshold, contact our lawyers at Vanasse Law today. We will help structure the best payout for your individual needs and ensure your needs are financially met.

Post-Traumatic Stress Disorder (PTSD) can develop after a trauma in any setting. Despite this fact, not all states allow Workers’ Compensation claims based on PTSD. For the states that do, the worker must have experienced or witnessed an event that is deemed traumatic while acting the scope of employment, then show symptoms of PTSD that interfere with the ability to work in that employment. Furthermore, there must be an official diagnosis of PTSD from a certified psychiatrist or psychologist.

Post-Traumatic Stress Disorder (PTSD) can develop after a trauma in any setting. Despite this fact, not all states allow Workers’ Compensation claims based on PTSD. For the states that do, the worker must have experienced or witnessed an event that is deemed traumatic while acting the scope of employment, then show symptoms of PTSD that interfere with the ability to work in that employment. Furthermore, there must be an official diagnosis of PTSD from a certified psychiatrist or psychologist.

Some examples of what is considered a traumatic event at work include, but are not limited to:

These types of events can trigger PTSD symptoms that greatly affect ones’ ability to perform their job.

Not every traumatic event results in PTSD. On the other hand, not everyone with PTSD has been through a dangerous event. Symptoms can show up years after the event or right after it happens. Symptoms that last more than a month and are severe enough to interfere with relationships are considered PTSD.

For diagnosis, an adult must have the following for at least a month:

Re-experiencing symptoms include, but are not limited to, flashbacks where the trauma is relived, bad dreams, and frightening thoughts. Avoidance symptoms include staying away from places, events, or objects that remind the person of the event, or avoiding thoughts or feelings about the event.

Arousal and reactivity symptoms include being easily startled, feeling tense or on edge, trouble sleeping, or angry outbursts. Cognition and mood symptoms include trouble remembering important parts of the event, negative thoughts about themselves or the world, guilt or blame, or loss of interest in formally enjoyable activities.

If you are suffering from PTSD as the result of a traumatic event that happened on the job, you could be entitled to compensation. Contact our attorneys at Vanasse Law today to find out how we can help.

Under the Workers’ Compensation Act, workers who are injured on the job are entitled to recover lost wages equal to two-thirds of their weekly wages. The Act also highlights the minimum and maximum adjustments with the benefit rate being set using the annual maximum that was in place when the injury occurred. This maximum is decided by the Department of Labor and Industry by calculating a maximum based on a state’s average weekly wage.

Under the Workers’ Compensation Act, workers who are injured on the job are entitled to recover lost wages equal to two-thirds of their weekly wages. The Act also highlights the minimum and maximum adjustments with the benefit rate being set using the annual maximum that was in place when the injury occurred. This maximum is decided by the Department of Labor and Industry by calculating a maximum based on a state’s average weekly wage.

For the year of 2017 in Pennsylvania, the maximum weekly compensation rate for the calendar year is $995, which is a 1.7% increase from last year. This has been determined under the Workers’ Compensation Act, Section 105.1 and 105.2 by the Department of Labor & Industry. This new rate applies to injuries that were sustained on or after January 1, 2017.

This year, those whose average weekly wages are between $1,492.50 and $746.25 will be compensated for 66 2/3rds of their weekly wages. Workers who earn between $746.25 and $552.78 will receive a flat rate of $497.50 each week. For earnings under $552.77 each week, the injured worker will receive 90 percent of their average weekly wages.

Since Workers’ Compensation is the loss of one’s earning capacity, the benefits are not taxable unless under specific criteria, such as when someone is also receiving SSDI or SSI benefits. Unfortunately, wage increases an employee would typically receive are not factored into these benefits. This means those living off these benefits for an injury from years ago don’t have the same opportunity to negotiate their salary or have increased for cost of living raises.

Each case for Workers’ Compensation is unique. If you are starting a claim, contact us today. At Vanasse Law, we have an experienced legal team that can guide you through the process to ensure you get the most benefits possible to help your recovery.

Under the Workers’ Compensation Act, a Worker Compensation Judge is able to award a claimant attorney fees when after an unreasonable content is a petition. This type of award is based on the facts and legal issues that were involved in needing an attorney for the petition. A WCJ will also decide the amount and the length of time allowed for the claimant to be reimbursed for such fees and weigh the skills needed, how long the proceedings took, along with the time and effort expended.

Under the Workers’ Compensation Act, a Worker Compensation Judge is able to award a claimant attorney fees when after an unreasonable content is a petition. This type of award is based on the facts and legal issues that were involved in needing an attorney for the petition. A WCJ will also decide the amount and the length of time allowed for the claimant to be reimbursed for such fees and weigh the skills needed, how long the proceedings took, along with the time and effort expended.

This becomes complicated when an appeal on the award is successful. When a WCJ awards the claimant attorney fees and the decision is reversed, the claimant is technically no longer entitled to that compensation. However, there was no clear precedent on refunding that compensation. A decision in 2016 by the Commonwealth Court of Pennsylvania determined the Employer and Insurer could request that a WCJ order can direct claimant counsel to refund those contest fees when the Employer is successful in their appeal.

The Court based its decision on Barrett v. WCAB (Sunoco Inc.) (Pa. Cmwlth. 2010). In the case, it was held that an employer and insurer can request reimbursement of litigation costs that were awarded and paid in the case when an appeal is successful. In Barrett, it was decided that allowing the claimant to keep the legal costs in which they were no longer entitled would be unjust enrichment. Furthermore, the Employer would be unable to recover legal cost awards from the supersedeas fund, meaning they would be deprived of any meaningful appeal after an incorrect award.

This reimbursement doesn’t put the claimant in any hardship as recovery is sought directly from the claimant’s counsel as opposed to the claimant. Prior to this decision, the Court believed the same reasoning could be considered just as applicable to the unreasonable contest attorney fee issue.

If you had an appeal go through successfully and are being asked to reimburse attorney fees directly, we can help. At Vanasse Law, our team understands the intricacies of these laws and will put together a defense in your favor. Contact us today to find out how we can help.

The Employee Retirement Income Security Act (ERISA) aims to protect the assets of your plan, but many are not well-informed on the responsibilities of the fiduciary who control or have authority over their plan. The first thing to understand is what a fiduciary is. Simply put, a fiduciary is someone who acts in your interests when it comes to your retirement plan.

The second part is understanding ERISA regulations of employee benefits.

ERISA has a specific set of standards of conduct for a fiduciary that acts on behalf of a plan’s beneficiary. These include:

If you have concerns about your retirement plan funds, talk to one of our Pennsylvania Workers Compensation lawyers at Vanasse Law today. We will help you navigate the intricacies of ERISA law.

In a recent ruling, the Fifth Circuit Court of Appeals has reaffirmed that not returning to work is not considered a reasonable accommodation. The ruling came from a case where an employee felt he had accrued enough time and benefits to leaving until the day after he was set to retire.

When there is no way to provide reasonable accommodations for an employee or their leave has been deemed indefinite by a medical professional, the options in returning to work are limited. However, this does not leave the employer on the hook with an empty desk chair, even under the ADA.

Even if a worker is not considered permanently disabled, how well they can function in their essential duties can heavily impact whether they can be afforded accommodations. Additionally, an employee cannot leave work without a specific date on which they will return, nor can they leave without any intention of returning, even in the case where they have accrued time enough to retire.

Sometimes, returning to work is not an option. However, workers still have options to help them through these difficult times. If you are physically able to work but cannot perform the essential function of your job, you may qualify for the Supplemental Job Displacement Benefit. This is issued when you have reached Maximum Medical Improvement but your employer does not offer a job in which you can perform.

Sometimes, returning to work is not an option. However, workers still have options to help them through these difficult times. If you are physically able to work but cannot perform the essential function of your job, you may qualify for the Supplemental Job Displacement Benefit. This is issued when you have reached Maximum Medical Improvement but your employer does not offer a job in which you can perform.

This benefit program helps to pay for necessities to return to work, such as a computer and re-vocational training. In some cases, you may also be able to get a re-vocational counselor to help with the transition.

It is important to know employers are not required to offer the same position as they do under FMLA leave. This means an employer can get a worker back in the workplace sooner under a new role, or training for a different position may be available. However, it could also mean a worker may not be as happy upon return. Planning ahead for these nuances could help both the employer and the employee find a solution to work best for the situation.

If you are unable to return to work, contact our Pennsylvania Workers’ Compensation lawyers at Vanasse Law today to find out your options. We will help develop a plan for your next stage of life.

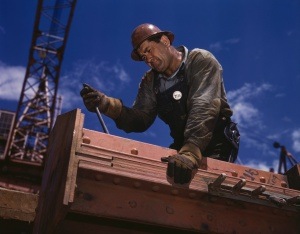

When you go to work each day, you do so with the best of intentions. No matter what your industry or occupation, it’s your goal to get through the day’s projects as best you can. There are things that can get in the way – unexpected roadblocks can take many forms. One of the biggest roadblocks you might encounter is a nagging injury. In a way, hidden or subtle injuries are far more insidious and damaging to you and your employer than an acute injury that comes from an on-site accident. This is because when you are confronted with an emergency situation, the impact of an injury is clear and predictable. In the case of a less visible problem like a back injury or a chronic lung condition, it may take time for you to link the condition to your work, or to make a decision to seek reimbursement through workers’ compensation. Holding off is fine, but you need to make sure that you don’t let so much time go by that you lose your workers’ compensation benefits. You need to keep aware of the time limit for filing a workers’ compensation claim in Pennsylvania, and to consult with an experienced workers’ compensation law firm.

When you go to work each day, you do so with the best of intentions. No matter what your industry or occupation, it’s your goal to get through the day’s projects as best you can. There are things that can get in the way – unexpected roadblocks can take many forms. One of the biggest roadblocks you might encounter is a nagging injury. In a way, hidden or subtle injuries are far more insidious and damaging to you and your employer than an acute injury that comes from an on-site accident. This is because when you are confronted with an emergency situation, the impact of an injury is clear and predictable. In the case of a less visible problem like a back injury or a chronic lung condition, it may take time for you to link the condition to your work, or to make a decision to seek reimbursement through workers’ compensation. Holding off is fine, but you need to make sure that you don’t let so much time go by that you lose your workers’ compensation benefits. You need to keep aware of the time limit for filing a workers’ compensation claim in Pennsylvania, and to consult with an experienced workers’ compensation law firm.

The statute of limitations that the state of Pennsylvania has imposed for filing a workers’ compensation claim is three years. This specifically applies to how long you have between the time that you are injured – or become aware of your injury – and the time that you complete and submit a claim petition. Failure to give this paperwork to the appropriate authority will preclude you from getting the compensation that you deserve.

In addition to the statute of limitations for filing the actual claim, Pennsylvania has prescribed specific time limitations on other aspects of the process. These include:

There are certain exceptions to each of these rules, including for those instances where a disease is occupational and takes an extended period of time to begin to manifest symptoms. Another is for those situations where an employer may have provided payments without the benefit of a workers’ compensation order being in place.

Every individual situation is different and has different requirements, so it is important that you speak with an experienced workers’ compensation attorney to ensure that your rights are preserved. The Pennsylvania workers’ compensation attorneys at Vanasse Law are here to help. Contact us today to learn more.

Alternative Dispute Resolution is a fancy term for mediation. It offers an option outside of litigation when two parties are having a dispute about how to resolve an issue. When Alternative Dispute Resolution is used to settle a legal disagreement, the two parties involved take their case to a mediator who has experience in the issue at hand, who will listen to both sides, then try to ask as a go-between to arrive at a mutually agreeable way to settle the matter. Alternative Dispute Resolution has become increasingly popular in a number of arenas for several reasons: it is generally a faster and less expensive process than going to court, and both sides generally end up feeling that they’ve had the opportunity to have their say during the proceedings, and to work together to come up with an answer – but that is not always the case. When it comes to Workers’ Compensation awards, the use of Alternative Dispute Resolution offers a couple of advantages. At Vanasse Law, we are happy to provide you with some helpful information on the process.

In Pennsylvania the Alternative Dispute Resolution Process provides the ability for both the injured worker and their employer to sit down and have an information discussion about their differences. A workers’ Compensation judge participates, working to help them each see the other’s side. This can happen through mediation, an informal conference, or a settlement conference. Many people prefer this process to the more formal workers’ compensation hearings because they can save both time and aggravation. Mediation is generally a faster process and the conversations are less formal: there is no sworn testimony, no need to prepare or provide exhibits, and no conversations are recorded. The lack of formality allows for a more open line of communication gives both sides the ability to speak directly and without interruption or formal framework about their concerns and their needs. Not only does this give both sides a sense of being heard, but also provides the ability to understand one another.

Perhaps most importantly, when Alternative Dispute Resolution is used, people feel that they have a better sense of control of the outcomes, a clearer sense for what to expect, and they are all able to do so without having to constantly appear at different hearings or to file appeals.

If you are considering choosing Alternative Dispute Resolution to resolve your Workers’ Compensation Award, remember that you always have the right to work with an attorney and to have them represent you throughout the proceedings. An attorney from the Lancaster law firm of Vanasse Law can provide you with both experience in negotiations and knowledge of workers’ compensation law that will work to your advantage. For more information, call us today to set up a convenient time for an appointment.